What Is a Deposit and Why It Matters

A deposit refers to the act of transferring funds into an account, whether for personal banking, online transactions, or business operations. Understanding deposit methods is essential for ensuring seamless financial management. Whether you’re funding a savings account or initiating an online purchase, choosing the right approach can impact your experience. Secure deposits protect against fraud, while efficient deposit processing time ensures timely access to funds.

Types of Deposit Methods Available Today

Modern deposit methods range from traditional options like checks and cash to digital solutions such as mobile banking apps. Online deposit options, including direct bank transfers and e-wallets, have gained popularity for their convenience. These methods allow users to fund accounts instantly, reducing reliance on physical branches. However, it’s crucial to evaluate the security of each deposit method before use.

How to Choose the Right Deposit Option for You

Selecting the ideal deposit option depends on factors like speed, cost, and security. For instance, online deposit options may offer faster processing times compared to mailed checks. Always consider deposit fees associated with each method, as they can affect your overall expenses. Prioritize secure deposits by verifying the credibility of platforms and using encryption protocols.

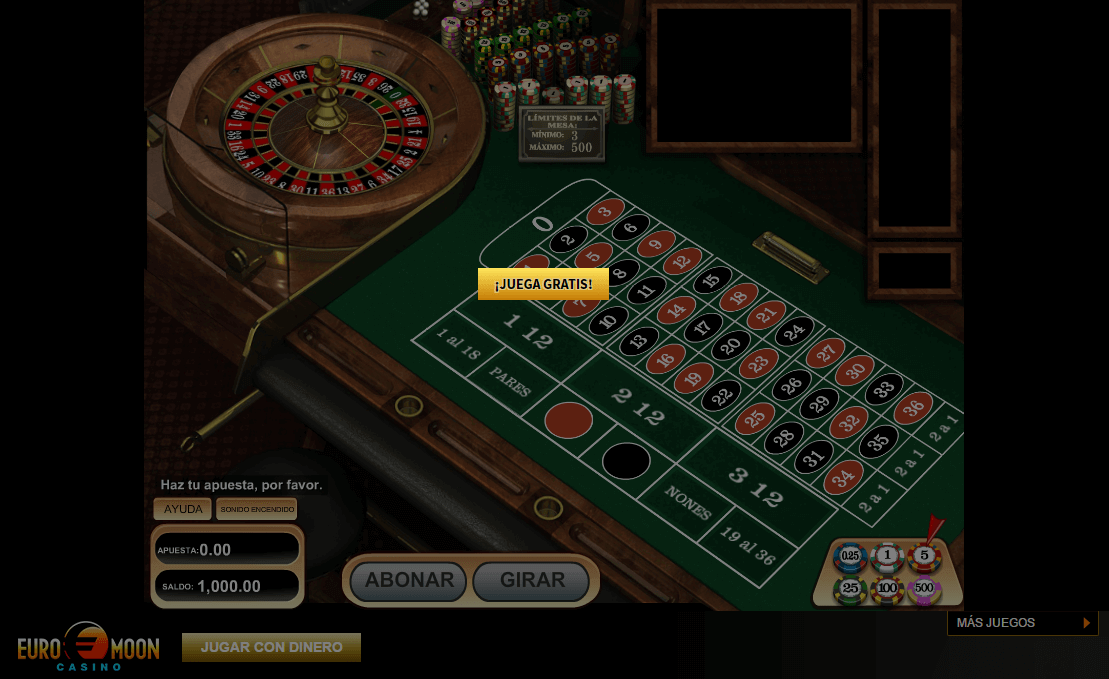

Security Measures for Online Deposits

Online deposit options require robust security measures to prevent unauthorized access. Look for platforms that employ two-factor authentication and end-to-end encryption. Reputable institutions often partner with trusted third-party services to ensure safe transactions. For example, las atlantis demonstrates how secure deposits can be integrated into digital systems with advanced safeguards.

Common Fees Associated With Deposits

Deposit fees vary depending on the method chosen. Some banks charge a flat fee for wire transfers, while others impose minimum balance requirements. Always review the terms of your account to understand potential costs. Comparing deposit fees across providers can help you save money in the long run.

Tips for Avoiding Deposit Errors

To minimize errors during deposits, double-check details like account numbers and transaction amounts. Use confirmations sent via email or SMS to verify successful processing. If you notice discrepancies, contact your financial institution immediately to resolve them before deposit processing time delays escalate into larger issues.

The Role of Banks in Facilitating Deposits

Banks act as intermediaries, ensuring deposits are securely transferred to the correct accounts. They also provide tools to monitor deposit activity and flag suspicious behavior. Modern banks increasingly leverage technology to streamline deposit methods, offering real-time updates and reduced processing times.

Emerging Trends in Deposit Technology

Innovations like blockchain and AI-driven fraud detection are reshaping deposit systems. These technologies enhance security while enabling faster deposit processing times. As more users adopt mobile-first approaches, expect deposit methods to become even more integrated with daily digital interactions.

Comparing International vs. Domestic Deposit Options

International deposit options often involve currency conversion and additional fees, whereas domestic methods are typically simpler. When sending funds abroad, consider exchange rates and the reliability of the deposit method. Secure deposits remain critical regardless of the transaction’s origin.

Legal Considerations When Making a Deposit

Deposits must comply with anti-money laundering regulations and other legal frameworks. Financial institutions are required to verify identities and report large transactions. Always ensure your chosen deposit method aligns with local laws to avoid penalties or account freezes.

Steps to Troubleshoot Deposit Issues

If a deposit fails or is delayed, first confirm the details with the sender and recipient. Contact customer support to investigate potential issues like insufficient funds or incorrect account information. Most institutions offer clear steps to resolve problems quickly, especially for online deposit options.

Best Practices for Record-Keeping After a Deposit

Maintain records of all deposits, including receipts, transaction IDs, and confirmation emails. This practice helps track deposit processing time and identify discrepancies. For businesses, accurate record-keeping ensures compliance with tax and audit requirements.

How to Stay Updated on Deposit Policy Changes

Subscribe to newsletters from your financial institution or follow regulatory updates to stay informed about changes in deposit policies. Regularly reviewing terms and conditions can help you adapt to new rules affecting deposit methods or fees.

Frequently Asked Questions About Deposits

- What are the most secure deposit methods? Secure deposits often involve encrypted online platforms or trusted banks with strong fraud prevention systems.

- How long does deposit processing time take? It varies by method—electronic transfers are typically faster than paper checks.

- Are deposit fees negotiable? Some institutions may waive fees for premium account holders or frequent users.

The Future of Deposit Systems in the Financial Sector

As technology evolves, deposit systems will likely become more automated and interconnected. Expect greater emphasis on secure deposits through biometric authentication and real-time monitoring. Innovations in deposit processing time and fee structures will continue to shape user experiences globally.