Content

While the we don’t acceptance big rate of interest incisions within the 2025, a financing industry membership is a fair place to keep your short-label supplies. But not, to own big cash holdings, savers might want to split up their funds ranging from an excellent Cd and a money field membership so you can protected large prices. However, money market account have varying APYs, when you’lso are trying to protect a-flat rates for a certain timeframe, consider a certificate of deposit (CD) rather. Vio Financial’s Foundation Currency Market Family savings includes a premier APY and low lowest deposit from $a hundred to start.

Minimum 1000 deposit casino – Do i need to do have more than one checking otherwise savings account?

- Plan try a different writer and you may assessment services, maybe not a good investment advisor.

- She furthered the woman company reports publicity, revealing on the houses areas and private finance for some celebrated publishings, such as Dow-jones’ Residence International and you may TheStreet.Formerly, Farran are the brand new secretary dealing with editor during the U.S.

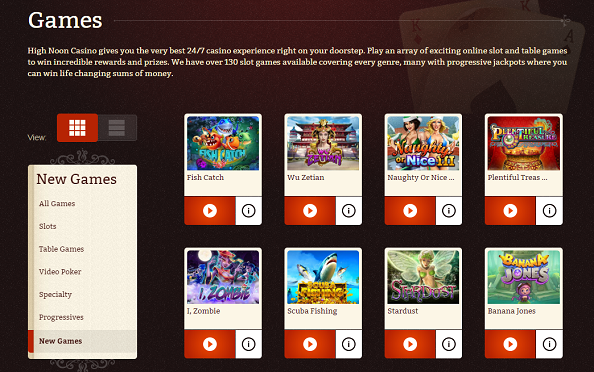

- That it gaming webpages now offers a huge acceptance added bonus really really worth upwards in order to $step 3,750.

- The hole minimum requirement of $dos,500 can be a bit higher compared to most other banking companies.

- OCM within the previous processing is wanting showing the brand new judge you to merely licenses in the Digit Lakes part will likely be from the thing, since the most other nations shouldn’t become affected because of the way the fresh York laws is written.

She first started while the a self-employed author, specialist and you will translator just before revealing your retirement opportunities at the Simple & Poor’s Money IQ. She state-of-the-art to fund all things private financing in the LendingTree, where she turned into a call at-house professional and created individual instructions to your subjects of vehicle to purchase so you can house re-finance and the ways to pick the best bank account. Specific charge card web based casinos defense deposit costs implemented because the of one’s credit-delivering loan providers while some don’t. We’lso are ok which have paying step three% charges, but some topic end up being a problem regarding the 5-10% will cost you and better.

Sallie Mae Financial

February 18,2024 – Subscribers for the newsletter remember that i’ve been suggesting to possess an amendment for the MRTA that would make it “in the rem” actions up against property that is knowingly always household illegal marijuana shopping transformation. The minimum 1000 deposit casino concept is that if a property owner otherwise property owner know or need to have recognized you to the renter is operating an illicit retail store, the actual property might possibly be at the mercy of municipal forfeiture. That have Nyc topping $180 million as a whole marijuana conversion inside 2023, the fresh Cab will be able to initiate providing these gives on the CGR Fund in order to community-dependent nonprofits and you will local governing bodies.

Choosing a top-Give Bank account

On the as well as top, the newest recommended rescheduling will allow a lot more research on the cannabis. Look to the marijuana because the a timetable We medicines very hard and minimal. Marijuana was first detailed more 50 years ago since the a good strictly prohibited drug, to your level with heroin and you may LSD and recognized as a compound with no recognized medical well worth and you may a life threatening abuse possible. Earlier efforts so you can reschedule marijuana within the National government had been declined.

However, the new terms of the brand new formal revocable trust may provide to have a good successor recipient or another redistribution of one’s believe places. Whenever all of these criteria is satisfied, the new FDIC usually ensure for each fellow member’s interest in the plan as much as $250,one hundred thousand, independently from people membership the new workplace otherwise employee might have inside a similar FDIC-covered business. The brand new FDIC usually identifies which exposure since the “pass-due to exposure,” since the insurance rates passes through the new workplace (agent) you to founded the fresh account on the personnel that is felt the newest proprietor of your own finance. Marci Jones provides four Single Profile at the same insured bank, and you to account from the name of the woman just proprietorship. The newest FDIC assures places belonging to a best proprietorship while the an excellent Single Account of one’s entrepreneur. The newest FDIC integrates the new four membership, and that equivalent $260,one hundred thousand, and you can guarantees the total harmony as much as $250,100000, making $10,one hundred thousand uninsured.

Who need to have an internet highest-produce family savings?

A fund market account providing you with you look at-writing privileges might help buy biggest expenditures from the savings. However, earliest consult with your lender to find out if it permits limitless payments playing with inspections or if perhaps here’s a detachment restrict. The fresh Government Set-aside Act authorizes the newest Panel to enforce put aside criteria to your transaction accounts, nonpersonal date places, and Eurocurrency obligations. If the tension of choosing you to Cd is simply too much, you can believe a method to harmony dollars access with a high production.

What is actually a finance industry account?

The fresh brief injunction up against OCM eliminated the brand new issuance from an extra 18 certificates, six where would have welcome shops to run in the Mid-Hudson Region. The newest identities of the half dozen Middle-Hudson shops are increasingly being withheld pending the outcomes of one’s litigation. So far, once more 2-1/couple of years, only 23 retailer companies have exposed, nevertheless state provides purchased unlock software broadly birth Oct. 4 and you may running to possess sixty months thereafter, without limits to your quantity of applicants otherwise certificates. The newest recommended law is actually an endeavor to better fall into line cannabis licensing laws and regulations on the conditions already in position to possess alcoholic drinks stores.