Blogs

More resources for transferring taxation, see point 11 away from Club. To learn more in the Irs Head Spend and making payments due to their Irs organization tax account, visit Irs.gov/Repayments. To learn more regarding the EFTPS or to join EFTPS, go to EFTPS.gov otherwise call one of several following numbers. We welcome claims offering courtroom gambling on line to expand within the the newest the long run.

No-deposit gambling establishment extra pros and cons

For additional info on digital commission choices, see Irs.gov/Payments. Avoid using Form 941 so you can report copy withholding otherwise taxation withholding to the nonpayroll costs for example retirement benefits, annuities, and gambling payouts. Statement these types of withholding to your Function 945, Annual Get back away from Withheld Federal Tax. Declaration jobless taxation on the Setting 940, Employer’s Annual Federal Jobless (FUTA) Tax Come back. High-give deals accounts’ distinguishing grounds is because they earn a much better APY than just conventional savings profile, which are commonly offered by brick-and-mortar banking companies.

- If you and your spouse is also’t generate joint estimated income tax money, apply this type of regulations to your independent estimated earnings.

- Amendments so you can prior season (2022) part put totals can be recorded thanks to July 30, 2023.

- We might along with disclose this information to other countries less than a taxation pact, so you can state and federal organizations to demand government nontax unlawful regulations, or even to federal the police and intelligence businesses to fight terrorism.

- Before you choose a term deposit, you can also guess the interest it does earn over the class of its label.

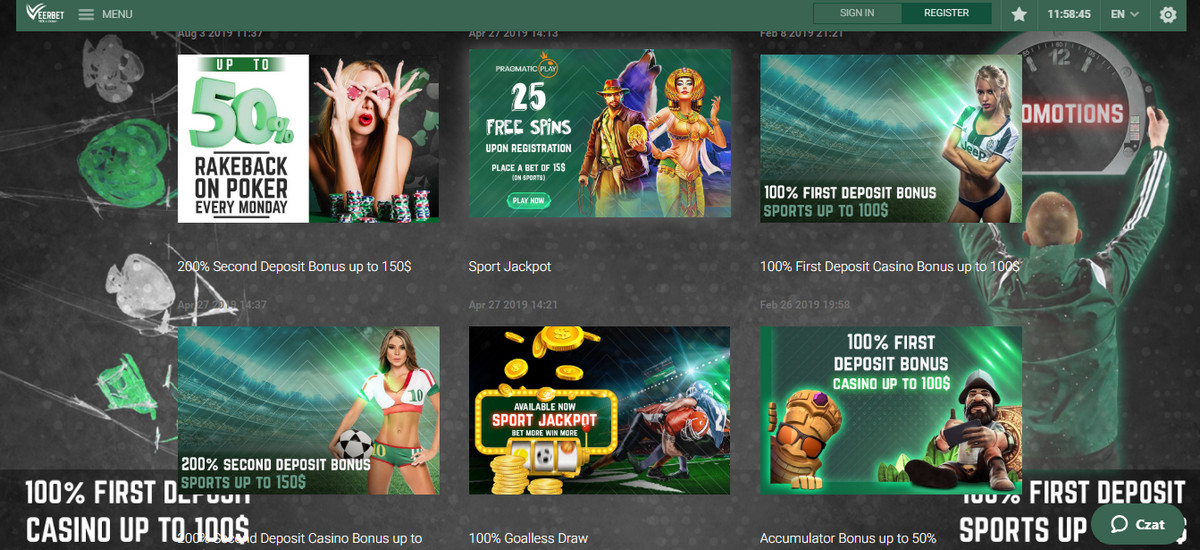

- The lower the fresh wagering conditions, more positive the advantage.

Oregon June EBT

Speaking of being carried out thru a lot more income tax rebates and you will instant fee to possess lower income professionals who filed a recent income tax get back. There is a virtually-no chance of money losings when you unlock a checking account in the a keen FDIC-covered lender, since your membership is actually insured for up to $250,100000. Officially, your money perform remove well worth in case your rising cost of living rates is actually highest than just your own APY, but that’s no different than a vintage family savings. Thus, beginning a top-give family savings is safe and you may worth considering.

- You need to render your boss an alternative Function W-cuatro per employment where you is actually switching your withholding.

- The newest deadline to have putting it to your impact ‘s the beginning of the the initial payroll period end 31 or higher months when you turn it inside.

- Once you learn of a single of them greater issues, report they to TAS during the Internal revenue service.gov/SAMS.

- A management commission out of $29 might possibly be billed and the membership often incur a destination lack of value of your currency withdrawn or transferred early.

CIT Bank Precious metal Savings

The newest BetMGM welcome incentive isn’t open to those in New york. Props is actually very well-known certainly sports gamblers and you can a great way to get in on the step you to definitely isn’t linked with the past score vogueplay.com snap the link right now of a game. At the BetMGM, you’ll find comprehensive props places including NBA props, anytime touchdowns, family runs, and three-advice, and games props such as first-half totals, the first party to help you rating, and. You’ll likely be able to find people sports betting field your’lso are looking for in the BetMGM, in addition to exact same-games parlays, player props, option outlines, and more. For individuals who’lso are a new comer to sports betting, browse the listing below to own a conclusion of the very most common kind of sporting events wagers.

Fidelity also provides buyers brokered Cds, that are Dvds granted by the banking institutions to your customers of brokerage firms. The new Cds are provided inside large denominations and the brokerage firm splits her or him to the shorter denominations to own selling in order to its consumers. Because the dumps try debt of your providing financial, and never the brand new brokerage, FDIC insurance can be applied. Licenses from put, otherwise Dvds, try fixed-income investment one to essentially shell out a set price of desire more a fixed time period. TAS works to care for large-size problems that apply to of a lot taxpayers. Once you know of one of those greater items, declaration it so you can TAS at the Irs.gov/SAMS.

Share an improve

The brand new Inflation Avoidance Operate from 2022 (the newest IRA) escalates the election amount to $five hundred,000 to have tax years beginning after December 31, 2022. The newest payroll tax credit election should be produced to your otherwise before the new deadline of your in the first place registered tax come back (and extensions). The newest portion of the credit put against payroll taxation is actually greeting in the 1st diary one-fourth beginning following the go out your accredited business submitted the income tax return.

To find out more and laws and regulations in the government taxation dumps, come across Transferring Your own Taxes, before, and part 11 out of Bar. If you would like proper people modifications said to your a previously submitted Function 941, complete and you can file Form 941-X. Function 941-X is actually an altered go back or allege to have reimburse which can be submitted independently from Mode 941. For additional info on just what wages is actually subject to Medicare tax, see section 15 away from Bar. For more information on A lot more Medicare Income tax, visit Internal revenue service.gov/ADMTfaqs.