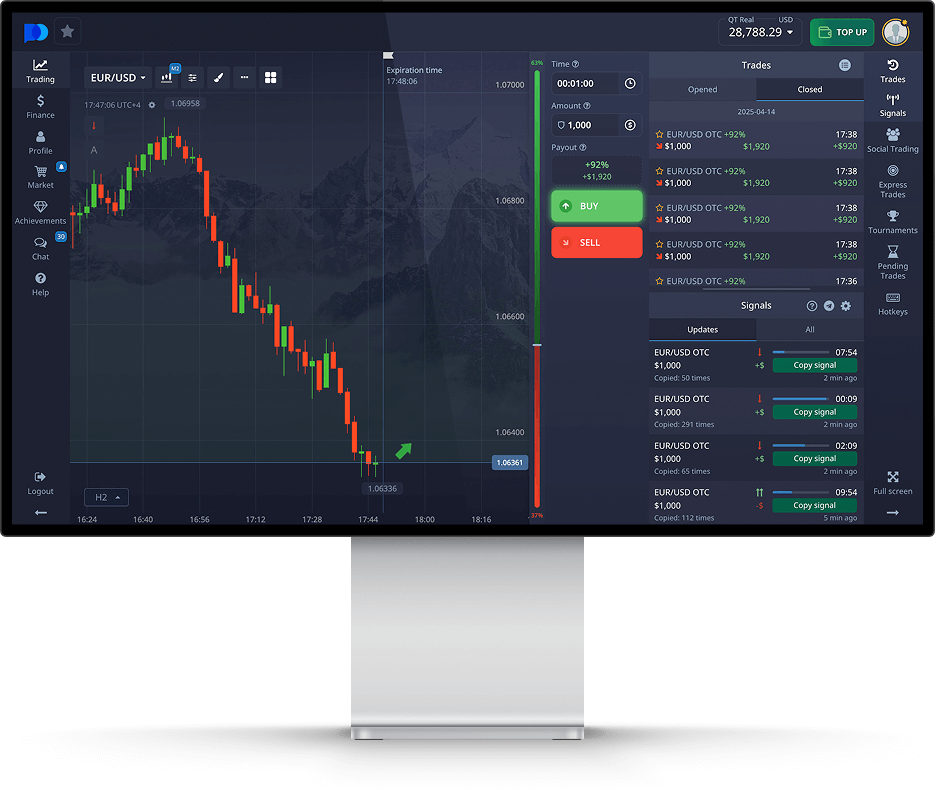

In the ever-evolving world of online trading, the legitimacy and safety of trading platforms are paramount concerns for traders worldwide. One such platform is Pocket Option, a broker that has garnered attention for its user-friendly interface and innovative trading features. This raises an important question: is pocket option a regulated broker торговля на Pocket Option In this article, we will delve into the regulatory status of Pocket Option, explore its licensing information, discuss the implications of regulation, and provide insights into the overall security of the platform.

Understanding Regulation in Online Trading

Regulation in the online trading industry serves as a layer of protection for traders. Regulatory bodies are established by governments to oversee financial markets, ensuring that companies operate fairly, transparently, and in accordance with the law. When a broker is regulated, it adheres to specific standards set by these governing bodies, which can include regular audits, compliance with financial practices, and measures to protect clients’ funds. The overarching goal of these regulations is to foster a safe trading environment.

Is Pocket Option Regulated?

Pocket Option is owned by Gembell Limited and operates under the jurisdiction of the Republic of Saint Vincent and the Grenadines. However, it is essential to note that while this location allows Pocket Option to operate with fewer regulatory constraints, the broker is not regulated by any major financial authority such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the USA, or the Cyprus Securities and Exchange Commission (CySEC).

The lack of regulation by a recognized authority raises significant questions about the safety and security of funds deposited by traders. It is crucial for potential users of Pocket Option to be aware of these factors before engaging in trading activities on the platform.

Implications of Being Unregulated

Trading with an unregulated broker can present various risks. Without the oversight of a regulatory body, traders may have limited recourse in case of disputes or fraudulent activities. Some of the key implications include:

- Risk of Mismanagement: Unregulated brokers may engage in practices that are detrimental to traders, such as misusing client funds or implementing unfavorable trading conditions.

- Lack of Transparency: Traders might not have access to important information regarding the broker’s operations, financial health, or trading practices.

- Difficulty in Dispute Resolution: Should a trader face issues with the broker, resolving disputes can be challenging without a regulatory authority to mediate.

- Limited Protection of Funds: Regulated brokers often offer protection measures for client funds, ensuring they are kept in segregated accounts. This is not guaranteed with unregulated brokers.

Security Measures Implemented by Pocket Option

Despite the regulatory concerns, Pocket Option has made efforts to implement various security measures to protect its users. Some of these measures include:

- Encrypted Transactions: Pocket Option utilizes SSL encryption to ensure that all transactions are encrypted and secure from potential cyber threats.

- Two-Factor Authentication (2FA): Users are encouraged to enable 2FA on their accounts, adding an extra layer of security during the login process.

- Client Fund Protection: Although not regulated, the broker claims to keep client funds in separate accounts from its operational funds, which is a common industry practice.

Comparing Pocket Option with Regulated Brokers

To appreciate the risks associated with using an unregulated broker like Pocket Option, it is beneficial to compare it with regulated options. Regulated brokers not only offer a safer trading environment but also often provide additional features, including:

- Client Fund Insurance: Many regulated brokers have insurance policies in place to protect traders’ funds up to a certain amount.

- Consistent Audits and Supervision: Regulated brokers are subject to regular audits, ensuring that they maintain compliance with industry standards and regulations.

- Clear and Defined Dispute Resolution Processes: Traders have clear avenues for reporting grievances and resolving issues with regulated brokers.

Conclusion and Final Recommendations

In conclusion, the regulatory status of Pocket Option is a crucial aspect to consider for anyone looking to trade on its platform. While it offers a variety of trading tools and a user-friendly experience, the absence of regulation by a recognized authority poses inherent risks. Traders must weigh the potential benefits alongside the risks of using an unregulated platform.

For individuals who prioritize security and regulatory compliance, it may be more advisable to seek out regulated brokers, who can offer a higher level of protection and peace of mind. Ultimately, the choice rests with the trader, but understanding the implications of trading with an unregulated broker like Pocket Option is vital in making informed decisions in the online trading landscape.