Mastering PrimeXBT Crypto Trading: Strategies for Success

In the rapidly evolving landscape of cryptocurrency trading, it’s crucial for traders to develop and adapt effective strategies to navigate the volatile markets. In this article, we will explore a variety of PrimeXBT Crypto Trading Strategies PrimeXBT trading strategies that can help traders maximize their potential for profits while minimizing risks. Whether you are a novice or an experienced trader, these strategies will enhance your trading journey.

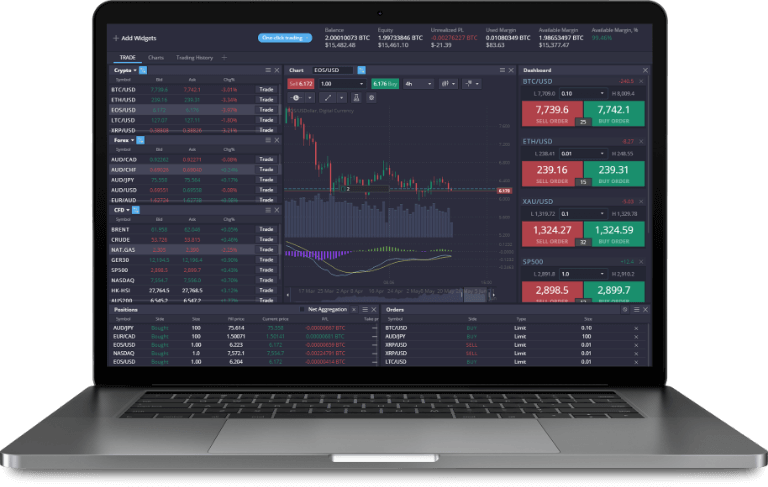

Understanding PrimeXBT

PrimeXBT is a powerful trading platform that allows users to trade a wide range of assets, including cryptocurrencies, Forex, commodities, and stock indices. One of the defining features of PrimeXBT is its ability to offer up to 100x leverage on cryptocurrency trades, making it an appealing option for those looking to amplify their trading results. However, while high leverage can lead to significant profits, it also increases the risk of loss, making the implementation of robust trading strategies essential.

1. Fundamental Analysis

Before diving into technical strategies, it’s crucial to understand market fundamentals. Fundamental analysis involves assessing the inherent value of an asset based on various factors, including market trends, news events, and economic indicators. For example, positive news about a particular cryptocurrency can lead to an increase in price, while negative news can result in declines. As a trader, keeping up with news and understanding the factors that influence price movements can provide you with a significant edge in the market.

Key Indicators for Fundamental Analysis

- Market Cap: The total value of a cryptocurrency, providing insight into its size and market presence.

- Volume: Trading volume indicates the activity level of a cryptocurrency, which can signal price movement.

- News Sentiment: Monitoring news sources and social media for public sentiment can help gauge market behavior.

2. Technical Analysis

Technical analysis involves analyzing price charts and identifying patterns that can suggest future price movements. Traders use various tools and indicators to help them make informed decisions. Some popular technical indicators include:

- Moving Averages: Used to smooth out price data and identify trends by averaging price movements over a specific time frame.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

- Bollinger Bands: A volatility indicator that consists of a middle band (moving average) and two outer bands that indicate volatility levels.

Implementing Technical Analysis on PrimeXBT

PrimeXBT provides advanced charting tools that allow traders to implement technical analysis easily. By analyzing price charts and using indicators, traders can identify entry and exit points for their trades, manage risk more effectively, and increase their chances of profitability.

3. Risk Management Strategies

Risk management is an integral part of any successful trading strategy. Even the best traders can encounter losses, and having a robust risk management plan helps protect your capital. Here are some key strategies:

- Set Stop-Loss Orders: This order automatically sells an asset when it reaches a predetermined price, limiting potential losses.

- Position Sizing: Determine the amount of capital to risk on each trade based on your total trading account and risk tolerance.

- Diversification: Spread your investments across different assets to mitigate risks associated with individual asset volatility.

4. Trading Psychology

One often overlooked aspect of trading is psychology. As traders, we are subject to emotions such as fear and greed that can cloud our judgment. Maintaining discipline and sticking to your trading plan is essential for long-term success. Here are some tips on managing emotions:

- Establish a trading routine to stay consistent.

- Take breaks to avoid burnout and emotional decision-making.

- Keep a trading journal to reflect on your trades and emotions during those trades.

5. Proven Trading Strategies

Now that we have covered various essential concepts, let’s look into some proven trading strategies that can be utilized on PrimeXBT.

Trend Following Strategy

This strategy involves identifying the current trend in the market (upward, downward, or sideways) and trading in the direction of that trend. This can be achieved through the use of moving averages, where traders buy assets when the price is above a certain moving average and sell when it is below.

Range Trading Strategy

Range trading involves identifying price levels where the cryptocurrency tends to bounce between support and resistance levels. Traders buy at support and sell at resistance, capitalizing on predictable price actions.

Scalping Strategy

This short-term strategy involves making a large number of small trades throughout the day, trying to capitalize on small price movements. Scalping requires a solid understanding of market volatility and quick decision-making skills, making it suitable for experienced traders.

Conclusion

Implementing effective trading strategies on PrimeXBT can greatly enhance your trading experience and profitability. By understanding fundamental and technical analysis, managing risks appropriately, and maintaining a disciplined approach to trading psychology, you can position yourself for success. Remember that continuous education, practice, and adaptation of your strategies are key to staying competitive in the ever-evolving cryptocurrency market. Happy trading!